Image source: clip4art.com

Okay, right off the bat, everyone who received a down payment for your first home from your parents put up your hand!

Good thing this is the Internet and that question really isn’t invading anyone’s personal information. However, on the other hand, this is the Internet and personal information of the masses is publicly available. Thank you Internet!

Disclaimer: There is nothing to be ashamed of if your parents did pay a bit of your way. And if you read the rest of this blog the market facts will put you at ease.

The Canadian Real Estate Madness (Market)

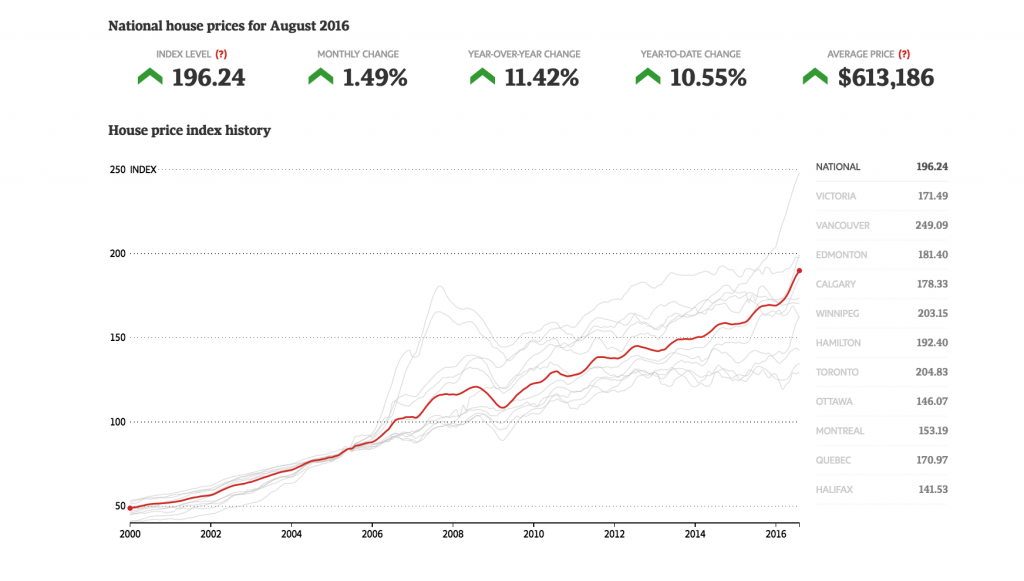

Since Y2K, we’ve seen a national year-over-year influx of 11.42% in the Canadian real estate market, leaving the average price for a home in Canada $613,186. This is a pretty penny for the average 29 year old, which is the average age of Canadian first time home buyers.

We have Vancouver and Toronto to thank for that high price tag average across Canada; nonetheless, we can thank Ontario’s vast yet diverse markets that balance out the provincial average to a more reasonable $518,000.

(Click the Globe and Mail’s national price index chart below for a more in depth look at other Canadian cities)

Toronto’s rapid demographic growth mirrors the rapid rise in real estate. The average purchase price for a home in Toronto is $710,000. Seeing that number might bring clarity to crazy number of condos popping up around the GTA. Fun fact, in 2014 Toronto had more highrise buildings under construction than any other city in North America, 130 to be exact! This is good news for first time home buyers hunting for a reasonably priced home in Toronto.

Canadian Association of Accredited Mortgage Professionals (CAMMP) says roughly 620,000 Canadian bought a home between mid 2013 to the beginning of 2015 and 45% of those purchasers were first-time buyers. So how many of those new homeowners got head start gifts from their parents?

The bank of Mom and Dad

If you do a Google search for “How many Canadian first time home buyers get down payments from parents” a bunch of articles and stats are available.

Here are a few favourites:

- “42 per cent of first-time buyers told an online survey that they expected their parents or relatives to help pay for their first home” – Financial Post

- “18% of first-time homebuyers get help from parents, CAAMP says” – CBC News

Most of articles are getting the stats from a The Bank of Montreal’s Home Buying Report. Internet facts are helpful but you have to wonder, are these numbers a true reflection of the market. And specifically how do these stats reflect first-time buyers in Toronto?

Matthew Buckingham, of Buckingham Mortgages, estimates that 80% of his Toronto based clients receive gifts from family for down payments.

The reality is saving for a down payment on a entry to mid level salary while paying Toronto priced rent doesn’t come easy. You can shift around the city to find cheaper rent but the map below shows that it might not be easy.

Image source: Huffington post

After you do the math, you’ll realize there’s little shame getting help from good ‘ol mom and dad.

In Conclusion, keep it coming bank of mom and dad…

For young Canadians looking to buy in hot housing markets like Toronto, turning to their parents for help might be the only way to land that first home. So thank you to moms and dads everywhere!

Did you know that gifting a down payment in Canada has future benefits to both parties? If you choose to gift your child money for a down payment, pay their monthly mortgage costs, straight up buy them a house; you aren’t taxed on the amount. If you choose to later have your children inherit your wealth, properties etc, they are subject to inheritance tax.

Long and short of it all, if you’re thinking of helping out your kids financially – Do it while they are just getting started – waiting until an untimely circumstance will cost everyone.