With 2022 coming to a close, the last of the housing market stats have been released. To summarize, last year, sales started off strong but began to decline and plateau throughout the spring/summer months due to the steep hike in interest rates from the Bank of Canada. The remainder of the year followed this trend as rates impacted the ability to purchase and in turn sustain the monthly affordability of home ownership with the high mortgage rates. I’m Danielle Demerino, a Toronto real estate agent and I am here to report to you on the real estate market stats from December 2022.

The Toronto Regional Real Estate Board (TRREB) reported a total of 75,140 sales in 2022, which reflected a decline of 38.2% when compared to the previous year of 121,639 recorded sales. We also saw a rise of almost 9% in the average selling price point sitting at $1,189,850 in 2022 compared to $1,095,333 the previous year. The inflation in price point is due to the strong start to the calendar year.

As we compare December 2022 and December 2021, we see evidence of price adjustments being made. While the gross volume of sales has fallen approximately 48%, inventory is up 169%. As with all supply and demand, we see the market shift. The supply is up, the demand seems down, and downward pressure on the pricing of properties reflects this trend. In fact, prices have fallen 9.2% from December 2021 to 2022.

Though the rise in supply shows availability in all housing types, with the current inventory (which is still considered low), the market still remains in the seller’s favour–preventing a trend of remarkable pricing decline.

Condo pricing continues to plateau, even with the 50% reduction in sales. Though borrowing rates continue to rise and freehold homes slowly moderate, it seems Condos remain a favourable and affordable path to investment, homeownership and first-time market entry.

2022 saw fewer new home builds enter the housing market, and reflected a lower report of sales. It appears investments have slowed, with the hesitancy of investors waiting on borrowing cost consistency before committing to new properties. It’s fair to say that building costs remain at a high, along with increased borrowing costs, which is preventing any remarkable changes in pricing models. That said, developers continue to attract new buyers with favourable promotions such as cashback on closing and rental guarantees.

In 2023, it’s safe to say that inflation rates will remain high, and we expect to see another increase in rates this January from the Bank of Canada. Without consistency in interest rates, the market trend should show an increase in available housing inventory, and a continued moderation of pricing, providing current buyers with more options.

It goes without saying that 2023 will be a fascinating year in the real estate world, with constant shifts and market opportunities. Let’s break down the stats based on some of our most popular regional real estate markets: the GTA, Toronto, Mississauga, Oakville, Durham Region and Brampton. The statistics below are year-to-date, which is the total sales from the first day of 2022 to present date.

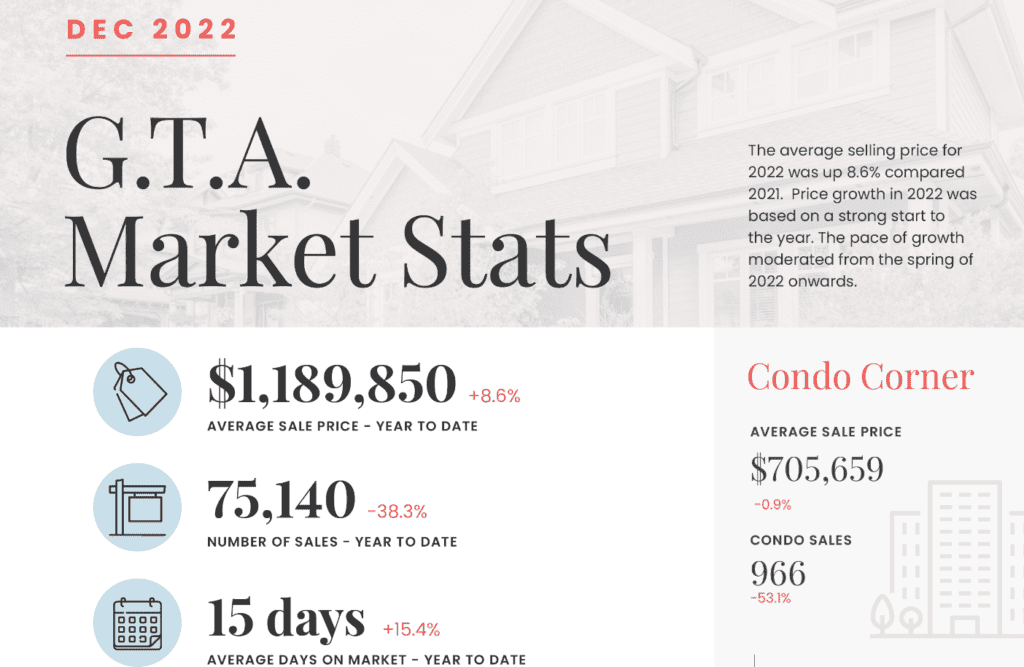

GTA Real Estate Market Stats

The GTA’s average sale price (all home types) was up by 8.6% in December 2022 to $1,189,850 (year-to-date) when compared to December 2021. Condo prices were down 0.9% to $705,659 (year-to-date) when compared to this time last year.

Toronto Real Estate Market Stats

Toronto’s average sale price (all home types) was up by 7.9% in December 2022 to $1,140,595 (year-to-date) when compared to December 2021. Condo prices were up 1.5% to $741,584 (year-to-date) when compared to this time last year.

Mississauga Real Estate Market Stats

Mississauga’s average sale price (all home types) was up by 10% in December 2022 to $1,117,107 (year-to-date) when compared to December 2021. Condo prices were down 6.7% to $612,597 (year-to-date) when compared to this time last year.

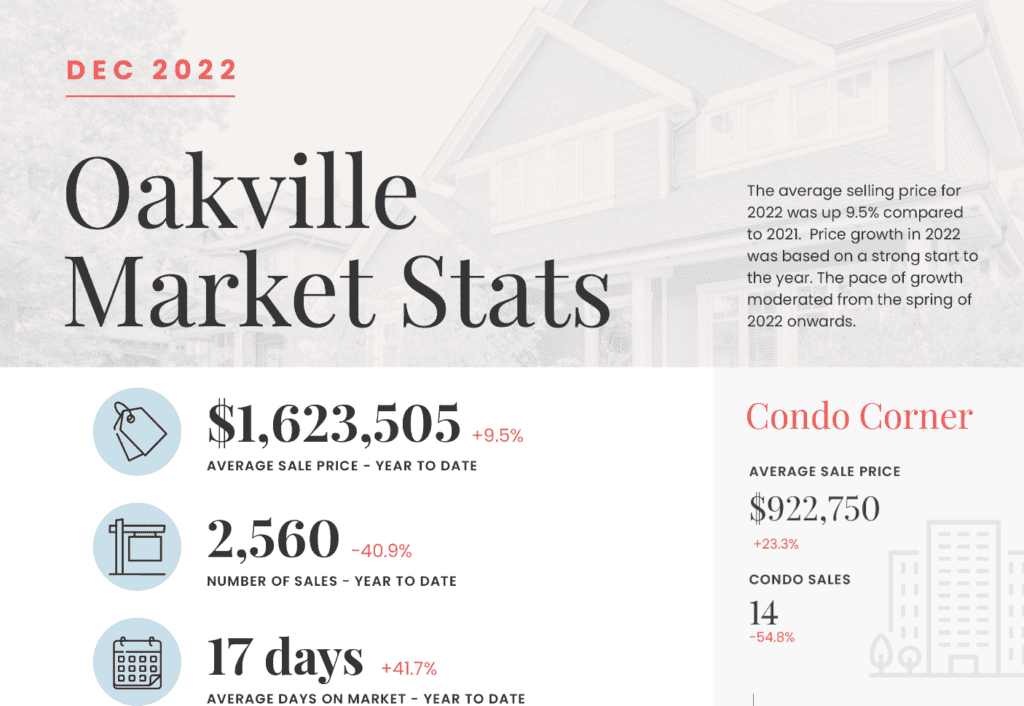

Oakville Real Estate Market Stats

Oakville’s average sale price (all home types) was up by 9.5% in December 2022 to $1,623,505 (year-to-date) when compared to December 2021. Condo prices were up 23.3% to $922,750 (year-to-date) when compared to this time last year.

Durham Region Real Estate Market Stats

Durham Region’s average sale price (all home types) was up by 10.7% in December 2022 to $1,024,570 (year-to-date) when compared to December 2021. Condo prices were down 4.5% to $534,788 (year-to-date) when compared to this time last year.

Brampton Real Estate Market Stats

Brampton’s average sale price (all home types) was up by 12.4% in December 2022 to $1,170,860 (year-to-date) when compared to December 2021. Condo prices were down 13.7% to $504,930 (year-to-date) when compared to this time last year.

There you have it, take in the numbers and let us know what you think! If you would like further market stats on a different region or neighbourhood, please do not hesitate to reach out via phone, email or website form! Contact details are below:

Danielle Demerino

ddemerino@royallepage.ca

416-728-5401

Brittany Huggins

bhuggins@royallepage.ca

647-863-7234